Thomas Lustenberger

My research interests are information economics, particularly expectation formation in monetary economics, macroeconomics and finance.

Research on expectation formation in monetary economics, macroeconomics and financeRecent activity

Our new working paper Is public support for the Euro influenced by Eurosystem speeches? (joint with In Do Hwang and Enzo Rossi) is available on SSRN.

Working paper on Eurosystem speeches and public support for the EuroAbout me

About Thomas LustenbergerResearch

Peer-reviewed articles

Journal of International Money and Finance (October 2023 issue, Vol. 137)

Working paper version:

Available on SSRN (paper version June 2022)

Abstract: Does communication influence trust in the central bank? We examine this question using survey data covering 488,000 Eurozone citizens from 1999 to 2019. We find compelling evidence that more communication, as measured by the number of speeches made by Eurosystem representatives, negatively impacts citizens’ trust in the ECB. This holds for speeches as a whole and for different groups of speakers. This effect was exacerbated during the global financial and European sovereign debt crises. We do detect a positive result from more speeches in the form of increased informedness on the ECB and the EU. However, the overall negative effect prevails.

Media coverage of this paper:

Journal of Money, Credit and Banking (October 2022 issue, Vol. 54, No. 7, pp. 2125 — 2148)

Working paper version:

WWZ Working Paper 2018-05 (paper version January 2018)

SNB Working Paper 2017-17 (paper version November 2017)

Abstract: We demonstrate how the precision of public and private information can be measured and their welfare implications can be assessed. To this end, we develop and apply a procedure to test welfare results from a beauty and nonbeauty contest model based on survey forecasts of interest rates in a large country sample over an extended period of time. In most countries, interest rate forecasts are unbiased. In half of the countries, a higher precision of public information regarding interest rates increases welfare. This applies in particular to small open and emerging market economies. During forward guidance, public information is less precise than private information. On average, forecasters place greater weight on public than private information and rapidly correct errors contained in private information, while errors in public information last over the whole forecast horizon.

Media coverage of this paper:

Journal of International Money and Finance (July 2021 issue, Vol. 115)

Working paper version:

SNB Working Paper 2020-17 (paper version July 2020)

Abstract: We analyze the economic impact of central banks sensed by business executives in a sample of 61 countries from 1998 to 2016. Based on a survey conducted by the Institute for Management Development (IMD), we find compelling evidence that intensive central bank communication, as measured by the quantity of speeches, worsens the perceived impact. During the global financial crisis (GFC), this effect became even stronger. In contrast, economic growth and a positive output gap improve the opinion executives have of their central bank's impact on the economy. Moreover, although less robustly, higher unemployment, and higher short-term interest rates worsen executives' opinion, while market uncertainty improves it. The level of inflation and an inflation targeting regime, central bank independence and transparency, financial crises, the zero lower bound constraint, forward guidance, the performance of the stock market, and the volatility of the exchange rate seem to be unimportant in this regard. A more detailed analysis shows that the effect of speeches depends on the identity of the speaker, the exchange-rate regime or an explicit employment mandate.

Media coverage of this paper:

- "Central bank communication: Remember who's talking" ("Zentralbank-Kommunikation: Es ist entscheidend, wer spricht"; Ökonomenstimme, 24-June-2021).

- "Central bank communication: Remember who's talking" (Vox, CEPR's Policy Portal, 12-May-2021).

- "Should Thomas Jordan blog and twitter?" ("Sollte Thomas Jordan bloggen und twittern?"; Sonntagszeitung, 13-Sept-2020).

International Journal of Central Banking (March 2020 issue, Vol. 16, No. 2, pp. 153 — 201)

Working paper versions:

WWZ Working Paper 2018-06 (paper version January 2018)

SNB Working Paper 2017-12 (paper version October 2017)

Abstract: In a large sample of countries across different geographic regions and over a long period of time, we find limited country- and variable-specific effects of central bank transparency on forecast accuracy and their dispersion among a large set of professional forecasts of financial and macroeconomic variables. More communication even increases forecast errors and dispersion.

Media coverage of this paper:

- "Two Audiences, One Lectern" (by Peter Coy, TECH ICONS, 10-Jun-2025).

- "Let's Not Return to the Bad Old Days of Central Bank Secrecy" (Bloomberg View, 14-Mar-2018).

- "A Cacophony of Central Bankers" (Wall Street Journal, 05-Mar-2018).

- "More frequent central bank communication worsens financial and macroeconomic forecasts" (Vox, CEPR's Policy Portal, 04-Mar-2018).

- "When central banks inform too much" ("Wenn Notenbanken zu viel informieren"; Zentralschweiz am Sonntag, 05-Nov-2017).

- "On forward guidance" (e-axes 360° Econ View, 12-Oct-2017).

- "Central Bankers Fare Better When They Are Tight Lipped" (Bloomberg, 11-Oct-2017).

- "More communication may hamper monetary policy, paper says" (Central Banking, 09-Oct-2017).

The dataset for our communication measure is available upon request, see section Data.

Book chapters

In Expectations: Theory and Applications from Historical Perspectives

(March 2020, Springer Studies in the History of Economic Thought, Arie Arnon, Warren Young, Karine van der Beek (eds), Springer, pp. 215 — 238)

Working paper version

CEPR Discussion Paper DP13187 (paper version September 2018)

Abstract: Even when all past and present information is known individuals usually remain uncertain about the permanence of observed variables. After reviewing the history and role of adaptive expectations and its statistical foundations in modeling this permanent-transitory confusion the paper investigates the consequences of this confusion for tests of market efficiency in the treasury bill and foreign exchange markets. A central result is that the detection of serial correlation in efficiency tests based on finite samples does not necessarily imply that markets are inefficient. The second part of the paper utilizes data on Israeli inflation expectations from the capital market to estimate the implicit speed of learning about changes in inflation and to examine the performance of adaptive expectations in tracking the evolution of those expectations during the 1985 Israeli shock stabilization as well as during the stable inflation targeting period.

Media coverage of this paper:

Working papers

Available on SSRN (paper version February 2025)

Abstract: We examine whether and how different types of Eurosystem speeches affect citizens' support for the euro. Using country-level panel data analysis and individual-level regression analysis for 19 euro-area countries over the period 1999-2023, we find compelling evidence that speeches delivered by representatives of national central banks significantly raise people's support for the euro. By contrast, speeches by Executive Board members do not affect public perception of the single currency.

Media coverage of this paper:

CEPR Discussion Paper DP15039 (paper version July 2020)

Abstract: We examine the cross-country relationships between measures of forecast uncertainty, forecast dispersion across individual forecasters and the variabilities of short-term interest rates and long-term yields. The main findings are: (i) Forecast uncertainty and forecast dispersion are positively and significantly related across countries for both short-term interest rates and long-term yields. (ii) A positive, albeit weaker, relation is found between forecast uncertainty and interest rate variability. (iii) Forecast dispersion of short-term interest rates and rates' variability are also positively associated. The evidence is followed by a Bayesian learning model that discusses conditions under which the results above are implied by theory.

SNB Working Paper 2018-10 (paper version May 2018)

CEPR Discussion Paper DP12489 (paper version December 2017)

Prepared for the 4th Thomas Guggenheim Conference on "Expectations: Theory and Applications in Historical Perspective", at Ben-Gurion University of the Negev, December 2017.

Abstract: This paper develops a model of honest rational professional forecasters with different abilities and submits it to empirical verification using data on 3- and 12-months ahead forecasts of short-term interest rates and of long-term bond yields for up to 33 countries collected by Consensus Economics. The main finding is that in many countries, less-precise forecasters weigh public information more heavily than more-precise forecasters who weigh their own private information relatively more heavily. One implication of this result is that less-precise forecasters herd after more-precise forecasters even in the absence of strategic considerations. We also document differences between the average forecasting errors of more- and less-able forecasters as well as substantial correlations between the forecast errors of different forecasters.

SNB Working Paper 2018-14 (paper version November 2018)

Abstract: In this paper, I derive and apply three univariate methods and one bivariate method to estimate permanent and transitory components of the American output growth path during the 1790 to 2017 period. The results show that statistical tests give little support to the hypothesis of significant permanent growth rate changes (univariate methods). The "special century" (1870-1970, as defined by Gordon (2016)) exhibited more volatile permanent shifts in the output level compared to recent decades (bivariate method).

Journal refereeing

American Political Science Review (APSR); International Journal of Central Banking (IJCB); Journal of Money, Credit and Banking (JMCB); European Economic Review (EER); Economic Modelling (ECMODE); Journal of International Financial Markets, Institutions and Money (JIFMIM); SNB internal papers.

Other publications

For a central bank to succeed, it needs public trust in its monetary policy and support for its currency. Yet as In Do Hwang and Thomas Lustenberger demonstrate, there is evidence the public perceives trust in the European Central Bank and support for the euro as two distinct concepts.

Central banks are intensifying their efforts to communicate with laypeople. One goal is to raise trust in their policies. This column shows that more frequent Eurosystem speeches lowered citizens’ trust in the ECB. Central banks may wish to coordinate the quantity of public talks to enable market participants, professional forecasters, firms, and households to take their messages as intended.

German:

Die «Finanzmarktaufsicht der Zukunft» (Die Volkswirtschaft, 23-December-2021).

French:

L’avenir de la surveillance des marchés financiers (La Vie économique, 23-December-2021).

Wie sieht die «Finanzmarktaufsicht der Zukunft» aus? Klar ist, ein zukunftsfähiger, immer stärker digitalisierter, innovativer Finanzplatz braucht auch eine entsprechende Aufsicht. Und: Die Zukunft beginnt heute. Die Eidgenössische Finanzmarktaufsicht (Finma) ist mit Gesuchen zu innovativen Geschäftsmodellen konfrontiert, die auf neuen Technologien aufbauen. Dabei beurteilt die Finma diese nach der ökonomischen Funktion und nicht nach ihrem technologischen Kleid. Die Finma setzt aber auch zunehmend selbst neue Technologien ein und erhöht so die Effizienz und Effektivität in der Aufsicht weiter. Menschlicher Sachverstand wird dabei nicht ersetzt, sondern ergänzt und bleibt ein unabdingbarer Bestandteil.

English:

"Central bank communication: Remember who's talking" (Vox, CEPR's Policy Portal, 12-May-2021).

German:

"Zentralbank-Kommunikation: Es ist entscheidend, wer spricht" (Ökonomenstimme, 24-June-2021).

Central bank communication has become an important policy tool over the past 20 years. This column uses survey data to show that business executives tend to associate a greater volume of speeches from the central bank with the central bank having less of an impact on the economy. Importantly, this effect stems not from speeches given by governors, but by other board members.

Almost 60 years ago, John Muth introduced the idea that adaptive expectations are rational if they efficiently use all available information. However, individuals are never fully certain, even ex post, about the permanence of economic developments. Using Israeli data, this explores the implications of this residual uncertainty for market efficiency. The findings point to issues with conventional market efficiency tests where ‘permanent-transitory confusion’ is in effect.

Most central banks communicate more openly with the markets than they did 20 years ago. The column argues that more speeches, more forward guidance, and more transparency has often worsened the accuracy of private-sector forecasts. Too much communication may be the problem, creating a cacophony of policy voices.

This is my Master Thesis. It received the Junior Research Award in Economics 2014 sponsored by Private Bankers of Basel, 3rd Prize (Nachwuchsförderpreis “Wirtschaft” der Basler Privatbanken 2014).

Data

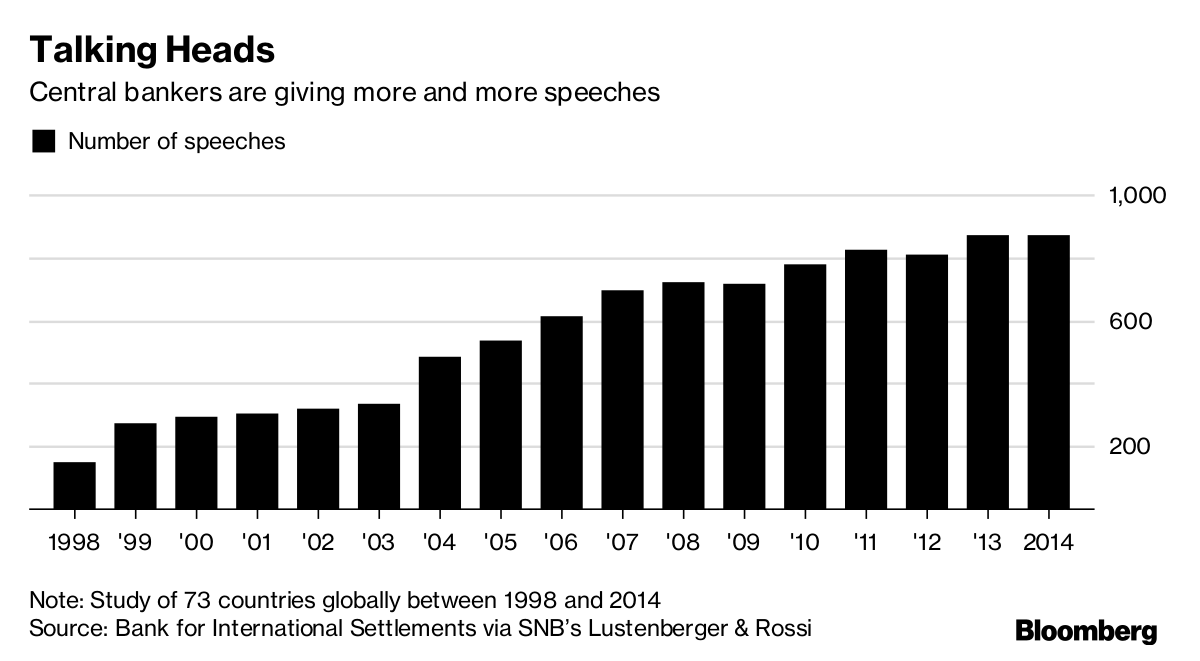

This dataset contains metadata for speeches from the BIS "Central Bankers' Speeches" database. Metadata include the exact date of the speech and the central bank that spoke. The dataset is updated to March 2019.

About me

My research interests include information economics, particularly expectation formation in monetary economics, macroeconomics and finance.

I earned my PhD in Economics from the Faculty of Business and Economics at the University of Basel, during which I also completed the Swiss Program for Beginning Doctoral Students in Economics at the Study Center Gerzensee. I hold a Master’s degree in International and Monetary Economics, conferred jointly by the University of Bern and the University of Basel.